Applications

Gro's decision-making applications take our machine learning analytics and models and add a layer of analysis to allow for better decision making.

Climate Risk Navigator for Agriculture

The Climate Risk Navigator for Agriculture gives a quick and up-to-date overview of weather and climate projections for over 40 major crops, for anywhere in the world. This application connects historical weather data, current and near term forecasts, climate projections out to 2100 for 5 scenarios, and proprietary Gro Climate Indicators such as drought and flood.

Land Suitability Model

The Land Suitability Model combines a range of agricultural, environmental, weather and climate data to assess the suitability of regions for growing certain crops now and in the future. This application identifies regions that are most suitable to grow a crop, given the highest yielding region or the region of choice for a company and regions most suited to grow a given crop in the future under 5 IPCC-compliant climate scenarios. This application is only available as an add-on to Enterprise-level subscribers.

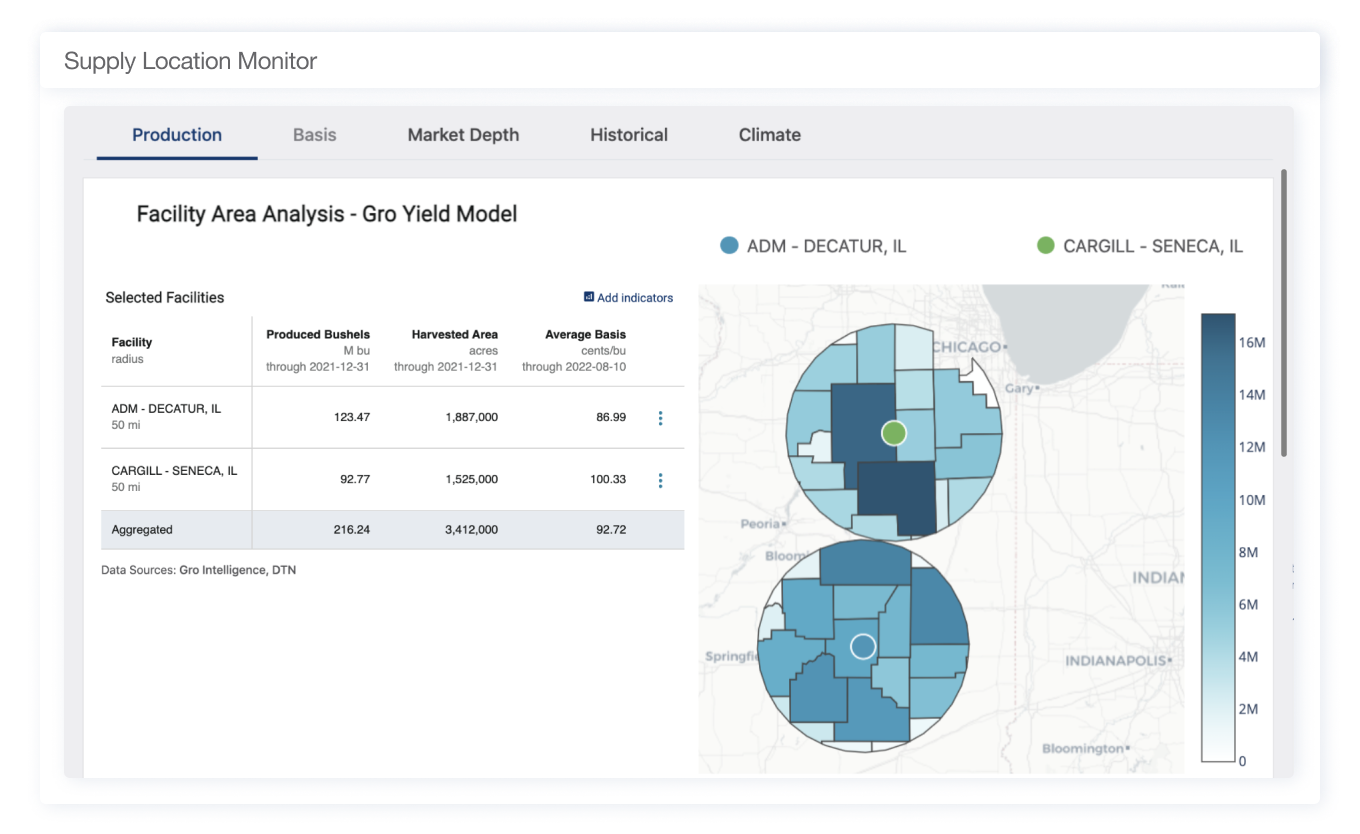

Supply Location Monitor

The Supply Location Monitor assesses the economics of buying, storing, and handling grain in each location across the US and compares the pricing risk around different areas of interest. The monitor uses a user-specified center, radius, and crop to show and analyze the drawing arcs surrounding competing facilities.

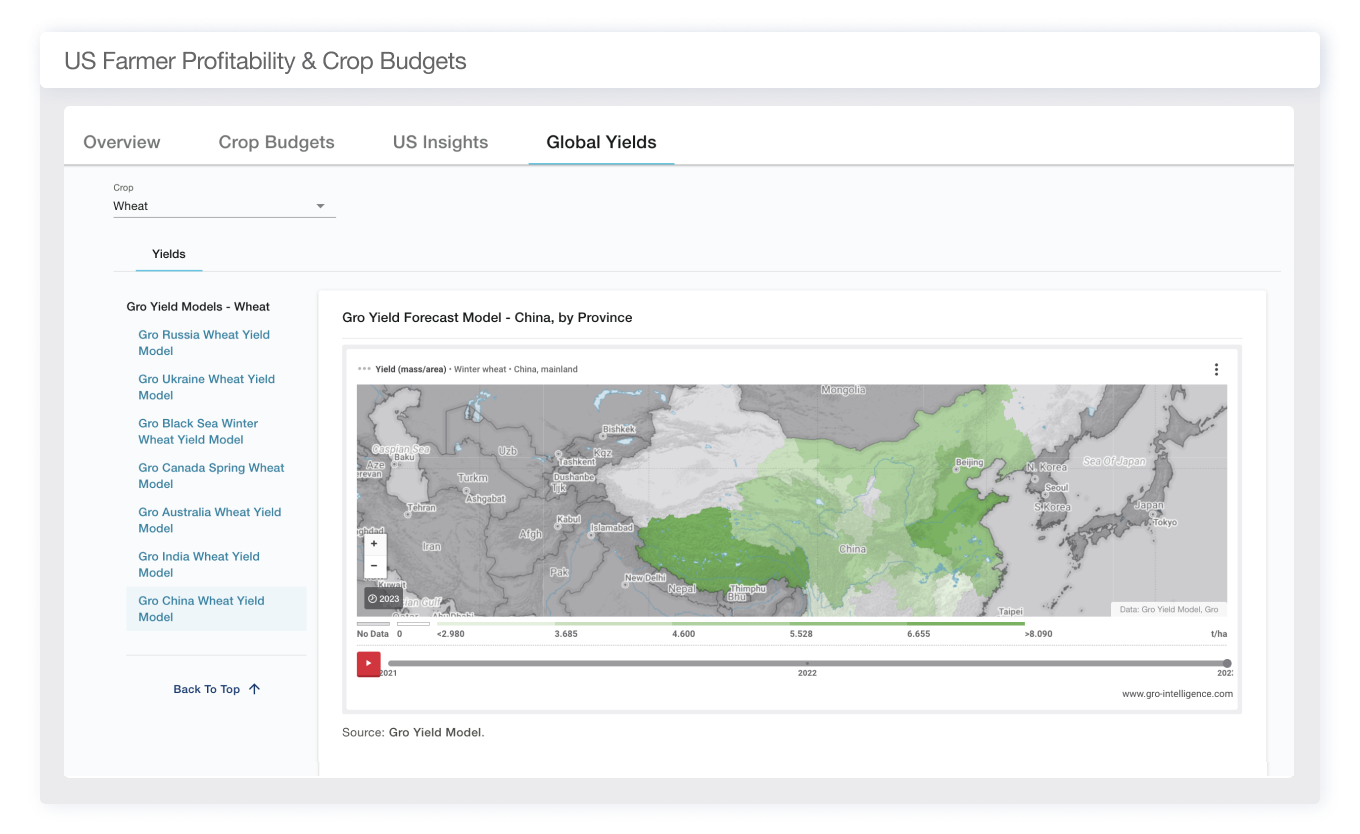

US Farmer Profitability & Crop Budgets Application

The US Farmer Profitability & Crop Budgets Application provides holistic views into US farmer profit and loss, combining disparate sources with proprietary Gro models across multiple variables, such as price, yield, and area. This Application generates unique, highly accurate forecasts to improve and expedite decision-making.

Search

Search