Black Pepper in Vietnam

Background

Medieval Europeans' quest for pepper, among other exotic food additives and fragrances of that era, created connections between a cloistered East and a booming West that otherwise may not have developed until centuries later. In a Europe suffering from poor food quality, substandard food safety precautions, and a lack of refrigeration, the arrival of cloves, pepper, and other aromatic and pungent spices must have seemed like a Godsend. Prices rapidly climbed to a point where a few pounds of pepper brought back from India would allow a sailor who survived the trip to buy and furnish a merchant's villa in Lisbon or Madrid. Spice revenue largely constructed the city of Venice, and both the British and French East India Companies owed their existences to the spice trade. The explorers who first reached the Americas consistently listed spices as their objectives on the same level as gold.

Vietnam Production

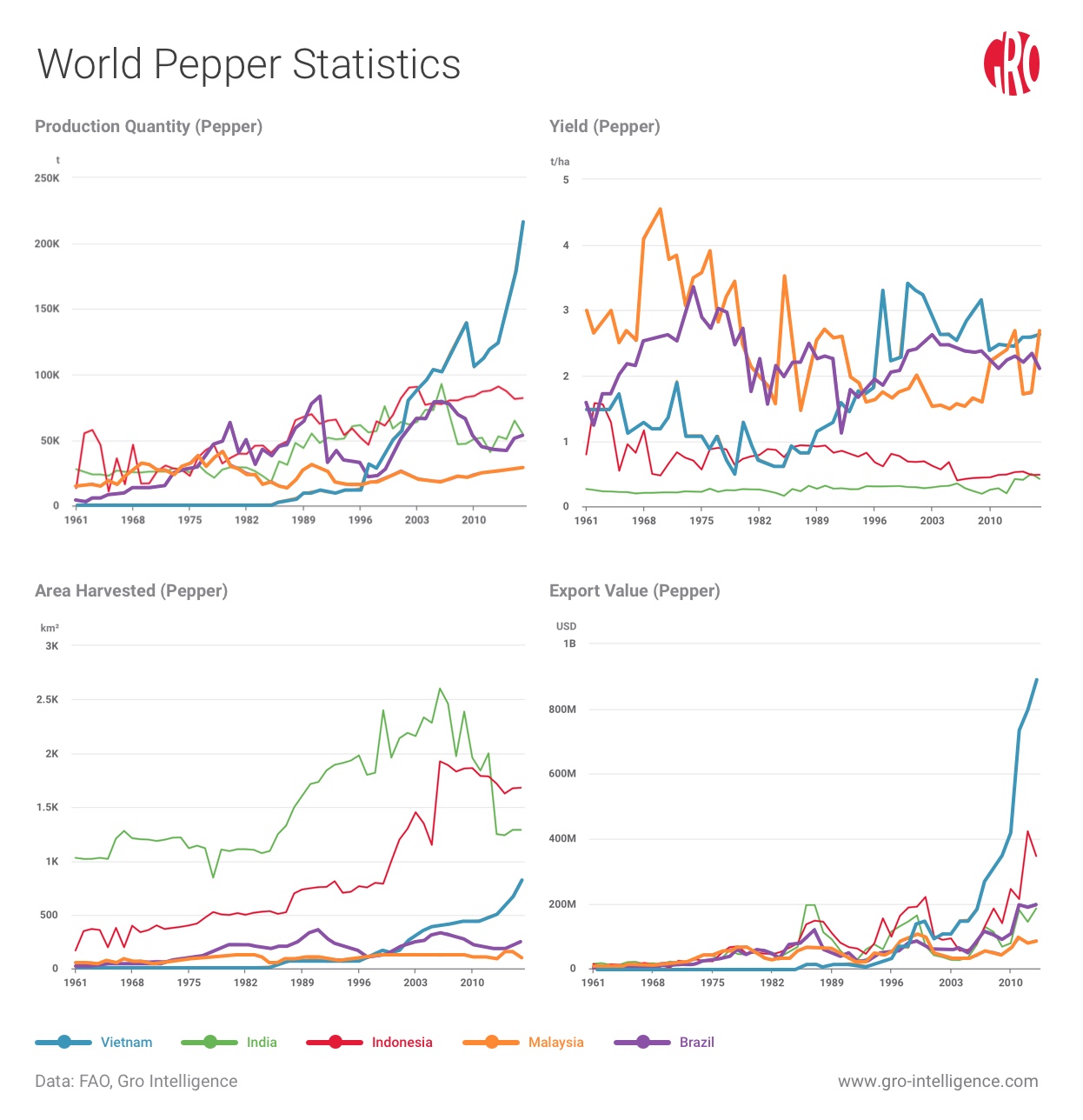

Vietnam made amazing strides in black pepper cultivation from the early-mid-1980s to the present. The charts below tell the story of how, from virtually no production in 1983, the country has rapidly boosted its crop to number one in the world. Intriguingly, area harvested has not exhibited the same rapid increase relative to competitors’. Vietnam achieved global dominance by the employment of modern farming techniques and the intense application of capital and labor to create a highly efficient pepper industry. In fact, more traditional producers in India and Sri Lanka enviously refer to the support of pepper growth by construction of concrete or brick pillars and the installation of drip irrigation as the “Vietnam technique". Now as modern methods of cultivation are gaining favor worldwide, it seems reasonable to expect a continuing boom in global production that may ultimately lead to a painful retrenchment for the industry. But for now, Vietnam remains the world’s undisputed king of pepper production and trade.

Currency Movements

The Vietnamese currency, the dong, has depreciated by almost 30 percent against the US dollar in the past ten years. Since the costs of land, labor, and capital associated with black pepper production are almost all domestic and the revenue almost all international, Vietnam’s currency depreciation has boosted the industry’s prospects significantly. However, Vietnam’s main competitors in the trade have also experienced currency depreciation. The table below shows the change in the price of each country’s domestic currency versus the dollar over the past ten years:

From a currency perspective, it seems reasonable to be concerned about emergent competition to Vietnam. Pepper supplies could become burdensome as Brazilian, Indian, and Indonesian farmers adopt successful techniques at lower costs. The Vietnam Pepper Association already encourages inefficient farmers to switch to alternate crops due to declining local prices.

Current Conditions

Despite huge investments in field technology, optimal Vietnamese pepper yield is still heavily dependent on good weather conditions. In theory, with advanced satellite data and knowledge of crop location, we can estimate the crop’s health from orbit. In practice, a lack of detailed information at the field level complicates the analysis. We have aggregated some useful satellite variables at the province level (analogous to counties in the US) and weighted them by crop area in each province. We have only used the provinces that we know to have significant pepper production: Bà Rịa–Vũng Tàu, Bình Phước, Đồng Nai, Gia Lai, Đắk Lắk, and Ðak Nông. These analyses provide a view of current and former crop-year conditions in Vietnam’s pepper farming regions.

Normalized Difference Vegetation Index (NDVI) Anomaly

NDVI data estimate visual greenness. In the charts below, a zero value indicates that the current situation is identical to the ten-year mean, while other values indicate either greener or less-green conditions. Each of the pepper provinces we have studied look healthy from this perspective. And when weighted by crop areas, the national index looks healthy.

Evapotranspiration (ET) Anomaly

“Evapotranspiration” describes the flow of water from earth to the atmosphere either by evaporation from land or transpiration through plants. Satellites can remotely sense this quantity and Gro’s geospatial experts have aggregated that data by local areas globally. The charts below display evapotranspiration anomalies relative to a seasonal median. Therefore, a value of 1.0 reflects a median value for a given month, whereas higher and lower values indicate either more or less water flowing through the process. By this measure, the crop again looks fine, with some uncertainty for the Ðak Nông province due to a rapid recent decline in ET anomaly. That local problem disappears when the numbers are aggregated to the national level, as positive ET anomalies elsewhere outweigh the negative values in Ðak Nông.

Consumers

Enthusiasm for spice usage continues to increase unabated around the world. Consumption remains heavily concentrated in the US, Europe, and Japan. As the global middle class grows in new areas in Asia, Latin America, and Africa, it seems reasonable to expect significant growth in spice and pepper use there as well. Recent history and long-term future projections both look quite positive for the demand side of the pepper market.

Conclusion

This analysis shows that Vietnamese black pepper production, if not acreage, should remain stable or increase in the short run and that weather conditions so far in 2018 point to a good harvest. Changing differentials in currency valuations and a spread of enthusiasm for the “Vietnam method” pose a growing threat in the long run. Constant monitoring remains the key to business intelligence and is critical to success. Gro Intelligence's unique combination of satellite and ground-based information allows subscribers to perform analyses such as this, that would previously have required entire corporate research departments to conduct.

Search

Search