Brazil Sugarcane Recovery Affects More Than Sugar

A sweet industry

Brazil is the largest producer and exporter of refined cane sugar. About 60 percent of the sugarcane in Brazil is produced in Sao Paulo. Sugar mills take in sugarcane to produce both sugar and ethanol in proportions determined by market factors. If ethanol prices are higher, a larger portion of sugarcane will be processed into ethanol. The ethanol mostly goes to flexible fuel vehicles or ethanol vehicles.

When sugar prices began declining from their peak in January 2011, the Brazilian economy was facing a similar downturn. While world sugar prices have seen periods of recovery and volatility, Brazil’s GDP has yet to fully recover. Periods of Brazilian real depreciation accompanied falling sugar prices between 2011 and 2015. Because most sugarcane mills had loans denominated in US dollars, the depreciating real coupled with declining sugar prices hurt the capital structure of many of these mills. Many sugarcane mills have since filed for bankruptcy protection. Other mills closed. World sugar prices recovered in August 2015, but that did not help capital-starved mills. The Brazilian sugarcane industry has entered into a phase where increasing sugar prices are not guaranteed to make things better because some mills can’t take advantage of the higher prices.

The industry’s recovery depends on more than just sugar prices. However, potentially lucrative alternatives are looking increasingly inaccessible.

Low fuel prices limit sugar alternatives

Ethanol produced by Brazilian mills mostly fuels ethanol vehicles or gets blended with gasoline to power flex fuel vehicles. Periods of falling crude oil prices from 2011 to 2015 and beginning again in October 2016 have ensured that gasoline is preferred to ethanol. Because it has less energy per gallon, ethanol doesn’t make sense for motorists above 70 percent of the price of gasoline. Also, the government chose to subsidize gasoline prices, further reducing ethanol demand. As a result, sugarcane mills opted to increase the amount of sugarcane refined into sugar. Ethanol imports would cover the supply deficit. The continued slump in crude oil prices has ensured that, even in a period of declining sugar prices, more sugar is produced because ethanol production remains unprofitable. Millers are therefore stuck producing low-priced sugar and are trapped in a futile cycle driven by slumping prices.

Data from the Brazilian Sugarcane Industry Association (UNICA) shows that hydrous ethanol consumption closely follows the trend in crude oil prices. As gasoline becomes more expensive, consumers opt for more ethanol at the pumps.

A depreciating Brazilian real relative to the US dollar put additional pressure on sugarcane mills in Brazil. Falling sugar prices and a depreciating currency that ensured most mills could not meet their dollar-denominated obligations to their creditors.

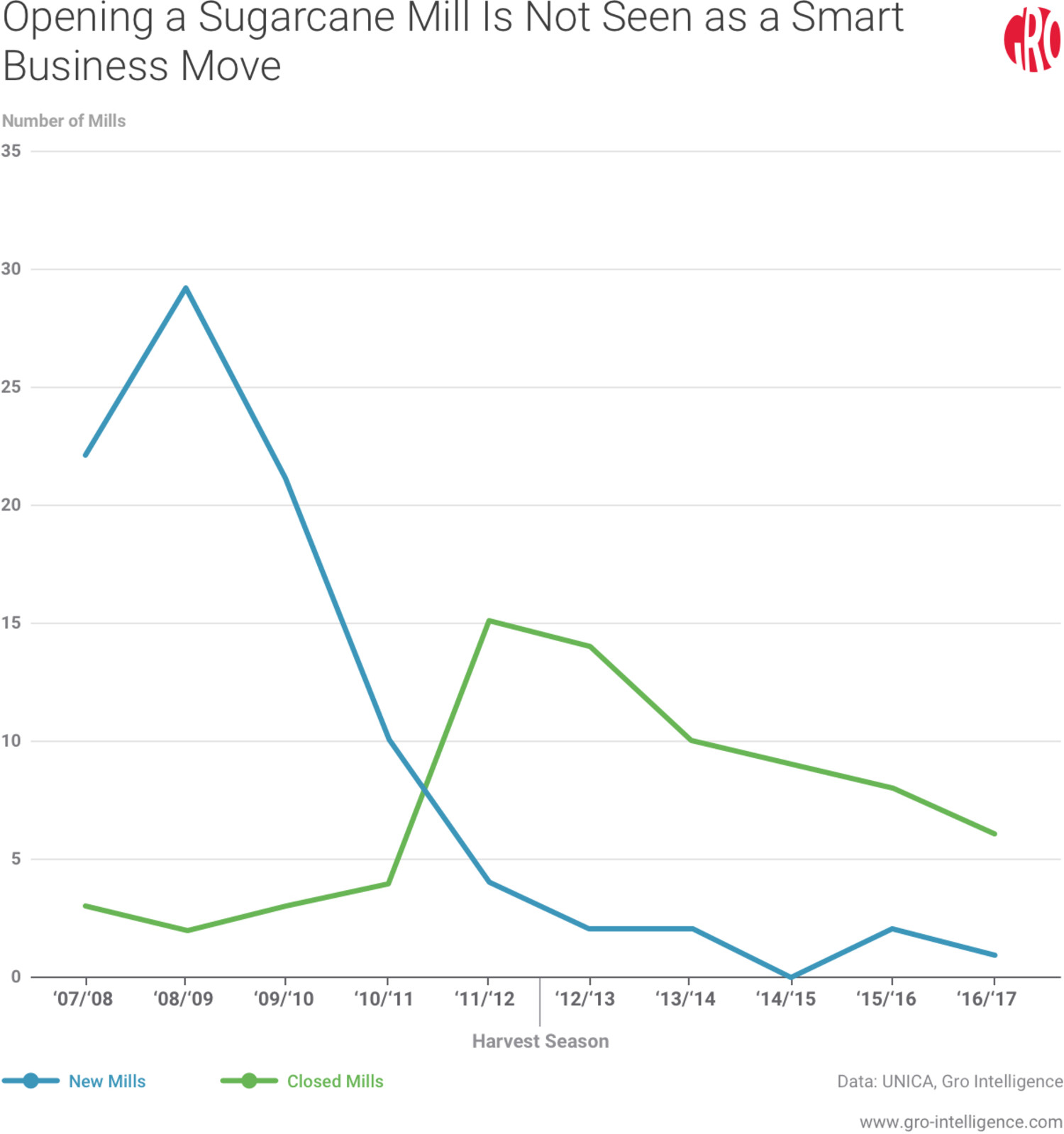

Many mills filed for bankruptcy protection. Between 2010 and 2017, 21 mills opened while 66 mills closed.

The automobile industry also suffered during the downturn in ethanol prices. Flex fuel vehicles made up the vast majority of new motor vehicle sales in Brazil, but consumers turned away from these hybrid gasoline vehicles along with traditional vehicles.

A shift in new motor vehicle sales

New motor vehicle sales closely follow the trend in gross domestic product (GDP). From 2000 to 2010, a decade of economic prosperity in Brazil led to a sharp increase in motor vehicle sales. The decline in GDP per capita that followed this period of economic prosperity led to a near-proportional decline in motor vehicle sales. New motor vehicle sales, like GDP per capita, have yet to recover. In fact, the trend has been downward. While flex fuel vehicles continued to make up the majority of new vehicles sold, the total declined sharply from peak sales in 2012.

Conclusion

The outlook for the sugarcane industry in Brazil is poor. The recovery in sugar prices in 2016 was short-lived. In many cases, mills that were trying to renegotiate their loans could not complete the process. Declines in sales of flexible fuel and ethanol vehicles, low gasoline prices, a declining Brazilian real, and a shortage of capital further complicate the financial position of existing mills. Sugarcane mills have even had to contend with low sugarcane yields because they cannot raise additional debt or equity capital to replant aging fields. Other mills have had to file for bankruptcy protection or close shop.

Brazil’s economy is seeing a resurgence with quarterly GDP at a 2-year high following a 7-year low in 2016. Crude oil prices are also expected to recover in the short term. Under these conditions, the industry is ripe for refinancing. High crude oil prices and higher taxes on gasoline (compared to fuel ethanol) in Brazil, together with a recovery of the domestic economy, will likely lead to increased fuel ethanol consumption and a decreased sugar surplus.

A well-funded sugarcane industry in Brazil could take advantage of new uses for sugarcane waste. With sugarcane straws making up about a third of total mass of sugarcane, mills can begin using this waste, just like they use bagasse, a pulpy cane sugar byproduct, for power generation. Estimates show that if straws were used in addition to bagasse, sugarcane mills could provide about 23 percent of Brazil’s power needs by 2023. If the industry can get additional capital—maybe through bankruptcies or acquisitions—then its road to recovery could be shorter than feared.

Insight

InsightBrazil Soybeans to Offset Argentina’s Frazzled Crop, Gro Models Show

Insight

InsightPoor French Sugar Beet Crop Adds to Global Sugar Inventory Woes

Insight

InsightBrazil Seen Ramping Up Corn Production as Global Trade Flows Shift

Insight

Insight

Search

Search